Table Of Content

The Clearing House Interbank Payments System differs from the Fedwire transaction service in several respects. First and foremost, it is cheaper than the Fedwire service, albeit not as fast, and the dollar amounts required to use this service are lower. CHIPS is the main clearing house for large transactions; the average transaction that uses CHIPS is over $3,000,000. Eliminate the work involved with responding to hundreds, perhaps thousands, of education verification requests each year — at no cost to you. Your students and graduates will appreciate the ability to obtain timely verifications helping them get jobs faster and meet graduate school deadlines.

January 6 Clearinghouse Congressional Hearings, Government Documents, Court Cases, Academic Research - Just Security

January 6 Clearinghouse Congressional Hearings, Government Documents, Court Cases, Academic Research.

Posted: Thu, 14 Mar 2024 07:00:00 GMT [source]

How The Clearing House Interbank Payments System Works

In general, this is termed transactional risk and is obviated by the involvement of a clearinghouse. In its absence, one party could back out of the agreement or fail to produce money owed at the end of the transaction. If the trader fails to meet the margin call, the trade will be closed since the account cannot reasonably withstand further losses. The futures market is highly dependent on the clearinghouse since its financial products are leveraged. That is, they typically involve borrowing in order to invest, a process that requires a stable intermediary. Clearinghouses act as third parties for futures and options contracts, as buyers to every clearing member seller, and as sellers to every clearing member buyer.

Choose Your Transcript Services Speed

The responsibilities of a clearinghouse include "clearing" or finalizing trades, settling trading accounts, collecting margin payments, regulating delivery of the assets to their new owners, and reporting trading data. Schools and educational organizations count on us for insights into learner success; to fulfill reporting requirements; and to make transcripts, data exchanges, and verifications easy. The Clearing House Interbank Payments System (CHIPS) is the primary clearing house in the U.S. for large banking transactions. As of 2015, CHIPS settles over 250,000 of trades per day, valued in excess of $1.5 trillion in both domestic and cross-border transactions.

Image Exchange

NSC SecurePrint℠ eliminates the time-consuming work of printing and mailing transcripts by hand. SecurePrint matches the look and feel of your institution-branded transcripts and provides unequaled security. Every financial market has a designated clearinghouse or an internal clearing division to handle this function. In the United States, this is the National Securities Clearing Corporation (NSCC), Canada uses the Canadian Depository for Securities Limited (CDS), and the E.U. Immediately verify enrollment and graduation information for students and alumni of most U.S. colleges and universities as well as high school diplomas. Our commitment to student privacy and compliance is why institutions, organizations, and learners nationwide trust the National Student Clearinghouse.

You can also choose any of our time-saving add-ons (see “Options You’ll Appreciate”). With each step up in speed, you’ll realize greater workload relief, lower administrative costs, and faster processing and delivery. PDF transcripts can be delivered electronically and securely within minutes to recipients worldwide.

We also offer add-on options such as Diploma Services, Third-Party Ordering, PDF-to-Data, and NSC SecurePrint. We offer high school transcript ordering and electronic exchange through the Clearinghouse Transcript Center. Clearinghouses are essential to the smooth functioning of the financial markets, They act as intermediaries, between the buyer and seller ensuring the smooth functioning of the markets. Stock exchanges such as the New York Stock Exchange (NYSE) have clearing divisions that ensure that a stock trader has enough money in an account to fund the trades being placed. The clearing division acts as the middle man, helping facilitate the smooth transfer of the stock shares and the money.

A ClearingHouse is a intermediary between a buyer and a seller in the financial markets, whose job is to ensure that both parties honor their obligations. Its role is to accomplish the steps that finalize, and therefore validate, the transaction. In acting as a middleman, the clearinghouse provides the security and efficiency that is integral to stability in a financial market. Sign up for Transcript Services at your speed and reduce your administrative burden. Our advanced data exchange systems transfer transcripts and other data privately, quickly, and securely.

Transcript Services

Gain student insights unavailable anywhere else with StudentTracker Premium Service. PDF-to-Data captures your incoming PDF transcripts and converts them into machine-readable files in a PESC-approved XML or EDI format for use in your student information system or CRM — in minutes. An investor who sells stock shares needs to know that the money will be delivered. Nearly 100% of America’s colleges and millions of students rely on the National Student Clearinghouse every day. The National Student Clearinghouse® Research Center™ provides year-round comprehensive reports on the evolving educational landscape. Read our latest reports on trends in enrollment, completion, and student pathways.

In this example, the clearinghouse has ensured that there is sufficient money in the account to cover any losses that the account holder may suffer in the trade. The initial margin can be viewed as a good faith assurance that the trader can afford to hold the trade until it is closed. These funds are held by the clearing firm but within the trader's account, and can't be used for other trades. The intention is to offset any losses the trader may experience in the transaction. Our insights help schools, outreach programs, and educational organizations support learners and set them on the path to greater success.

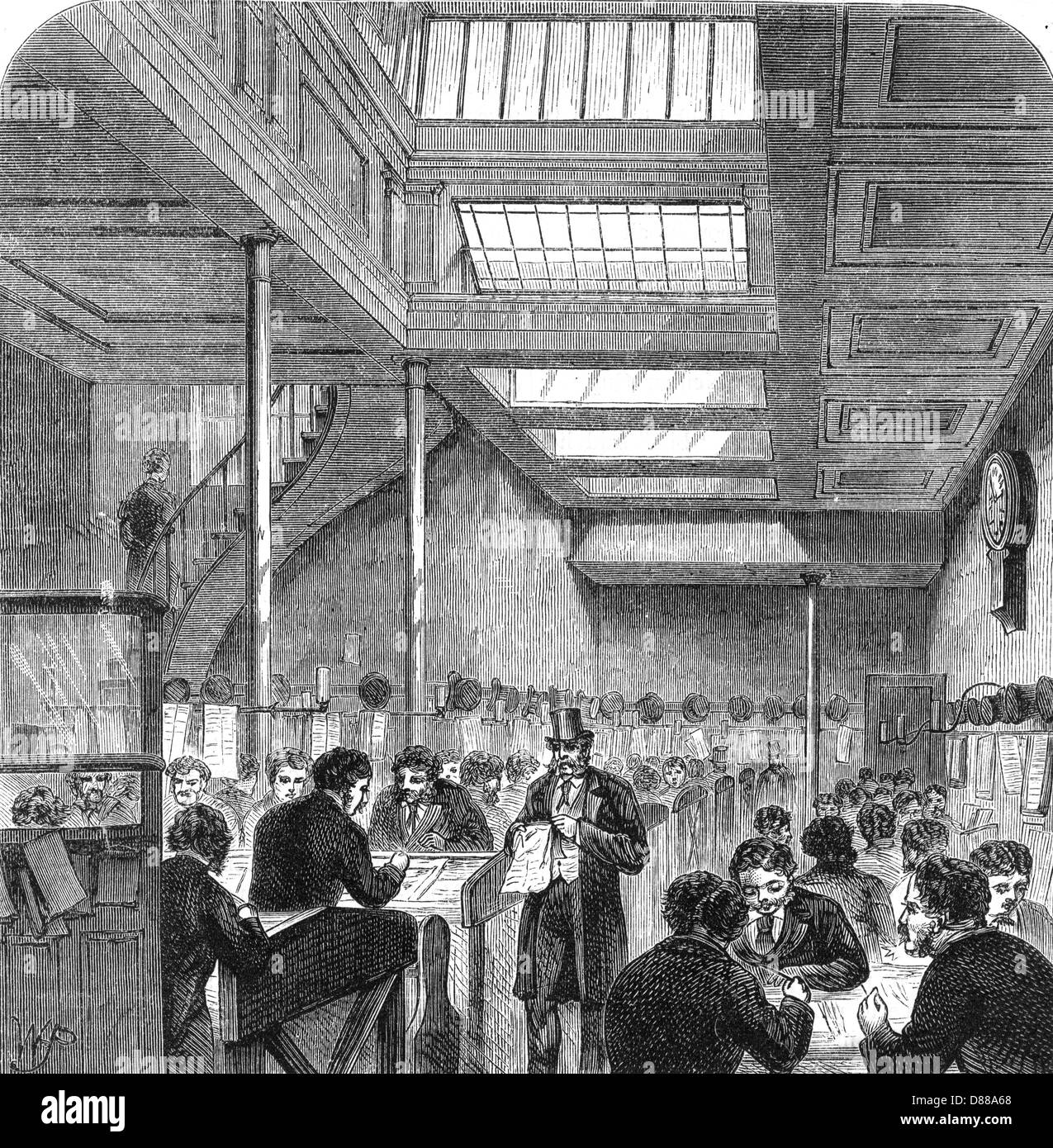

In some systems, financial institutions may contract with one or more third parties to help perform clearing and settlement activities. Financial exchanges, such as commodities futures markets and stock exchanges, began to use clearing houses in the latter part of the 19th century. In 1874 the London Stock Exchange Clearing-House was established for the purpose of settling transactions in stock, the clearing being effected by balance sheets and tickets. The Consolidated Stock Exchange of New York used clearing houses from its inception in 1885. This exchange existed in competition with the NYSE from 1885 to 1926 and averaged 23% of NYSE volume. In order to act efficiently, a clearinghouse takes the opposite position of each trade, which greatly reduces the cost and risk of settling multiple transactions among multiple parties.

Most large-value funds transfer systems are credit transfer systems in which both payment messages and funds move from the payer financial institution to the payee financial institution. An institution transmits a payment order (a message that requests the transfer of funds to the payee) to initiate a funds transfer. Typically, large-value payment system operating procedures include identification, reconciliation, and confirmation procedures necessary to process the payment orders.

While their mandate is to reduce risk, the fact that they have to act as both buyer and seller at the inception of a trade means that they are subject to default risk from both parties. The Clearing House launched the RTP® network in November 2017 to bring real-time payments to the U.S. Today the RTP network’s real-time payment capabilities are accessible to financial institutions that hold close to 90% of U.S. demand deposit accounts (DDAs), and the network currently reaches 65% of U.S. The RTP network was built for financial institutions of all sizes and serves as a platform for innovation allowing financial institutions to deliver new products and services to their customers. Financial Institutions can integrate into the RTP network directly, through Third-Party Service Providers, Bankers’ Banks and Corporate Credit Unions. To find more information on the RTP network and how to join the real-time payments revolution, visit our online library or contact us directly.

Secure Token Exchange is an optional capability that issues tokens to stand in for real account numbers when sending or receiving payments. The RTP Volume Calculator estimates approximately how many RTP transactions your depository institution will receive each month based on asset size. Businesses rely on us to take the guesswork out of verifying academic credentials and for industry-based and custom solutions that leverage our unique educational data resources. An online database that gives employers and government agencies real-time access to information about CDL driver drug and alcohol program violations. Before sharing sensitive information, make sure you’re on a federal government site.

A clearing house is a financial institution formed to facilitate the exchange (i.e., clearance) of payments, securities, or derivatives transactions. The clearing house stands between two clearing firms (also known as member firms or participants). A broker is a person or entity through with customers can access the financial markets and place trades. The clearinghouse handles the back office operations after the trade is placed, ensuring the trade is cleared. A clearinghouse is a designated intermediary between a buyer and seller in a financial market. The clearinghouse validates and finalizes the transaction, ensuring that both the buyer and the seller honor their contractual obligations.

No comments:

Post a Comment